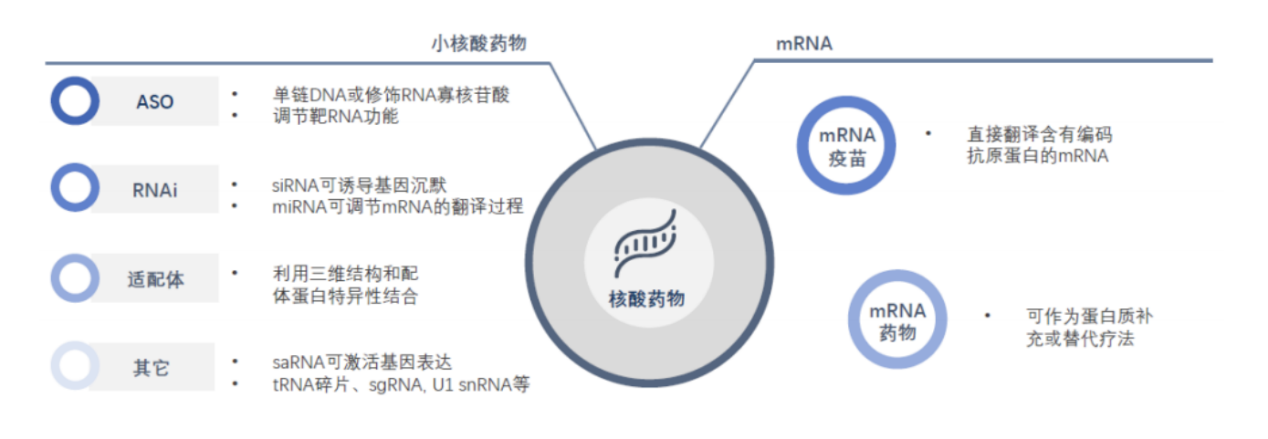

Small nucleic acid drugs mainly include antisense oligonucleotides (ASO), small interfering RNA (siRNA), microRNA (miRNA), small activating RNA (saRNA), messenger RNA (mRNA), RNA adapter (Aptamer), etc.

The research in the sub fields of ASO and siRNA small nucleic acids is quite popular, and the marketed drugs mainly focus on both

Principle of antisense oligonucleotide (ASO) technology: ASO has a small molecular weight (about 18-30 nucleotides) and is a synthesized single stranded nucleic acid polymer that can regulate gene expression through various mechanisms. There are three pathways through which ASO regulates gene expression: the first is that after binding to mRNA, ASO forms steric hindrance, preventing mRNA from entering the ribosome for protein translation, resulting in downregulation of the gene information carried by this mRNA. Option 2: ASO binds to target mRNA through complementary base pairing and recruits RNA enzymes to degrade the mRNA, resulting in downregulation of gene expression. The third method is mainly aimed at the binding of ASO to a certain exon region of pre mRNA during the formation of mRNA, causing this exon to be cleaved and not included in the final generated mRNA. So far, there have been 9 ASO nucleic acid drugs approved by the FDA for marketing, but 2 early ASO drugs have been delisted due to low sales and other reasons. Currently, there are 7 on the market.

The principle of RNA interference (RNAi) technology is the sequence specific gene silencing phenomenon caused by the binding of antisense RNA and target gene mRNA in the form of complementary base pairing. Long stranded double RNA (dsRNA) is cleaved into siRNA (small interfering RNA) and binds to proteins to form siRNA induced interference complexes (RISCs). RISCs then bind to complementary mRNA (messenger RNA) to degrade target gene mRNA, ultimately silencing specific gene expression and achieving gene therapy that regulates specific target gene expression in patients. There are currently 5 siRNA drugs approved for market by the FDA.

Nucleic acid drug classification, image source: CITIC Construction Investment

Compared with traditional drugs and biopharmaceuticals, small nucleic acid drugs have many advantages: they have high specificity and can target specific genes; Not limited by target drug efficacy; Development is relatively simple and has a high success rate; Long half-life and low frequency of administration; Fast production speed, obvious platform advantages, etc.

market analysis

Small nucleic acids have entered the public eye with their unique advantages and continuously expanded their boundaries. Among the marketed drugs, 86% are used to treat rare genetic diseases, of which 9 are ASO and 5 are siRNA. In 2021, the total global sales of the above-mentioned drugs exceeded 3 billion US dollars. Among them, the most successful commercialization is the Nusinersen injection, which was launched in 2016 and is the world's first drug to treat spinal muscular atrophy (SMA). Within 5 years of its launch, the total sales reached 6.8 billion US dollars. Representative marketed drugs include the long-acting lipid-lowering drug Incisiran, which was approved by the FDA in December 2021. This drug has similar efficacy to existing monoclonal antibody drugs, but only needs to be injected once every six months. The frequency of injection for monoclonal antibody drugs is 2 weeks or 1 month, so it has a significant advantage in sales. In addition, there are nearly 170 nucleic acid drugs in clinical trials worldwide, mainly used to treat liver, eye, skin, nervous system diseases, and tumors

Among the major MNCs, Novartis is also one of the major companies that has made far-reaching arrangements for small nucleic acids. Behind the first ASO drug Fomivirsen (discontinued) and the first common disease siRNA drug Incisiran, Novartis can be found. In 2019, Novartis acquired The Medicine Company for a sky high price of $9.7 billion, thereby acquiring all equity in Incisiran. Incisiran was approved for listing by the European EMA and FDA in 2020 and 2021, respectively. Inclisilan only took 5 years from clinical phase I to submit NDA, and is currently on the market in Europe, the United States, and China. It is also considered the most promising siRNA drug for sales. Evaluate Pharma expects its annual sales to exceed $3 billion. The success of Incisiran has validated Novartis's wise layout in siRNA drugs. However, beyond siRNA, Novartis had already collaborated with Ionis in 2019 and included Ionis's ASO small nucleic acid drug Pelacarsen in its portfolio. Pelacarsen is currently undergoing evaluation in Lp (a) HORIZON (NCT04023552), a global, multicenter, double-blind, placebo-controlled critical phase III study conducted by Novartis. The data is expected to be released in 2025.

Overview of Domestic Small Nucleic Acid Market

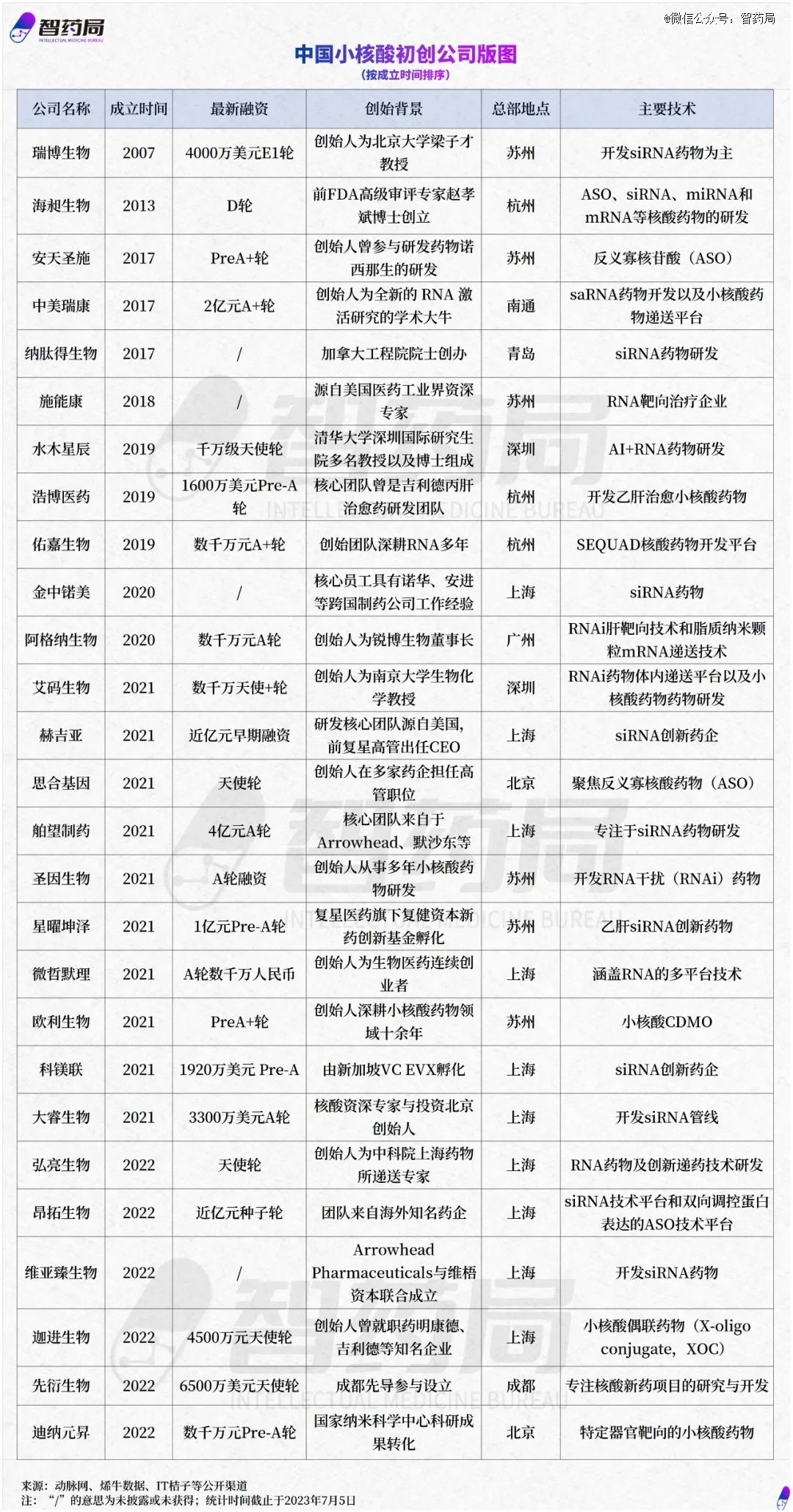

According to the statistics of the Intelligent Drug Administration, there are 27 small nucleic acid drug startups in China, mainly concentrated in the Yangtze River Delta and Pearl River Delta regions, and also distributed in Beijing, Qingdao, Chengdu and other places.

The main reason is that the biopharmaceutical industry in the Yangtze River Delta region is developed, with strong support for cutting-edge biotechnology, and the clustering effect of related industries is obvious.

Among them, Shanghai is the most prominent, attracting 10 enterprises to land, and its industrial chain layout is also relatively complete.

In July 2022, the establishment of the Shanghai Nucleic Acid Industry Park began, and the settled enterprise is Zhaowei Biotechnology. Zhaowei Biotechnology is a global producer of oligonucleotides and gene monomers. The company plans to invest 2.5 billion yuan to build a small nucleic acid drug research and development production base and expand downstream. In addition, Microorganisms and Junshi Biotechnology have also established small nucleic acid drug research and development platforms.

Another highland of the nucleic acid industry is Suzhou, where more than six small nucleic acid companies have settled in. Suzhou has invested heavily in biopharmaceuticals and is also forward-looking in bringing industry leaders such as Sanofi Pharmaceuticals and upstream service company Jima Gene into its portfolio.

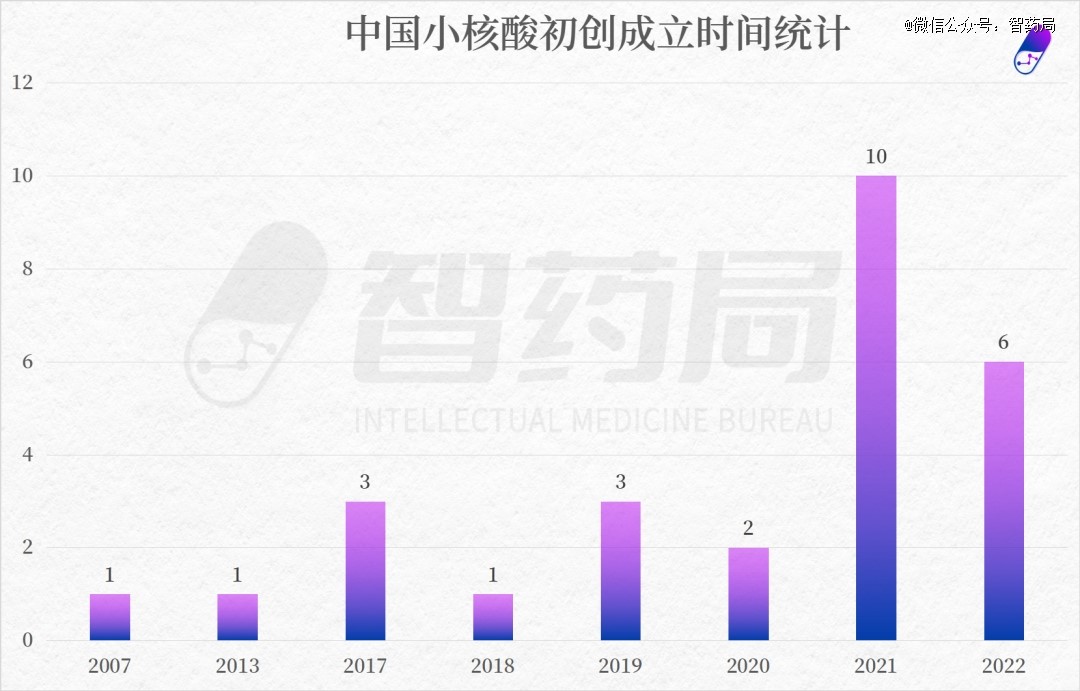

From the perspective of establishment time, the establishment time span of small nucleic acid pharmaceutical enterprises in China is relatively large. The earliest batch of companies can be traced back to 2007, such as Sanofi Pharmaceuticals and Ruibo Biotechnology.

Starting from 2017, a new batch of small nucleic acid startups have been established one after another. The reason is that in 2004, the RNAi drug Bevasiranib entered clinical practice, and large pharmaceutical companies and venture capital institutions began to flock to this field. However, due to immunogenicity and delivery systems, the small nucleic acid field began to enter a downturn. Until the emergence of technologies such as LNP, GalNac delivery systems, and chemical modification, the field of small nucleic acid drugs once again experienced vigorous development after 2016, and the industry entered a harvest period.

At present, the global small nucleic acid industry is gradually entering the fast lane of development. With the continuous maturity of research and development technology, the application fields will continue to expand, and drugs in the clinical stage will continue to be launched, international large pharmaceutical companies are constantly entering the track, and the small nucleic acid market is further opened up. Standing at the forefront is just around the corner.